Top 6 Emerging Financial Advisory Firms (With Their Growth Strategy)

The field of Financial Advisory Services is highly competitive, with hundreds of already well-established financial planning and wealth management firms offering similar services.

Thriving in the space not only requires a quality-driven and adaptable approach to financial service provisions but also a robust growth strategy in order to expand and flourish in this dynamic and competitive industry.

In this post, we will study the growth strategies of these top 6 emerging financial advisory firms in 2024– understanding how they achieved sustained success and rapid growth over the years.

1) Bogart Wealth

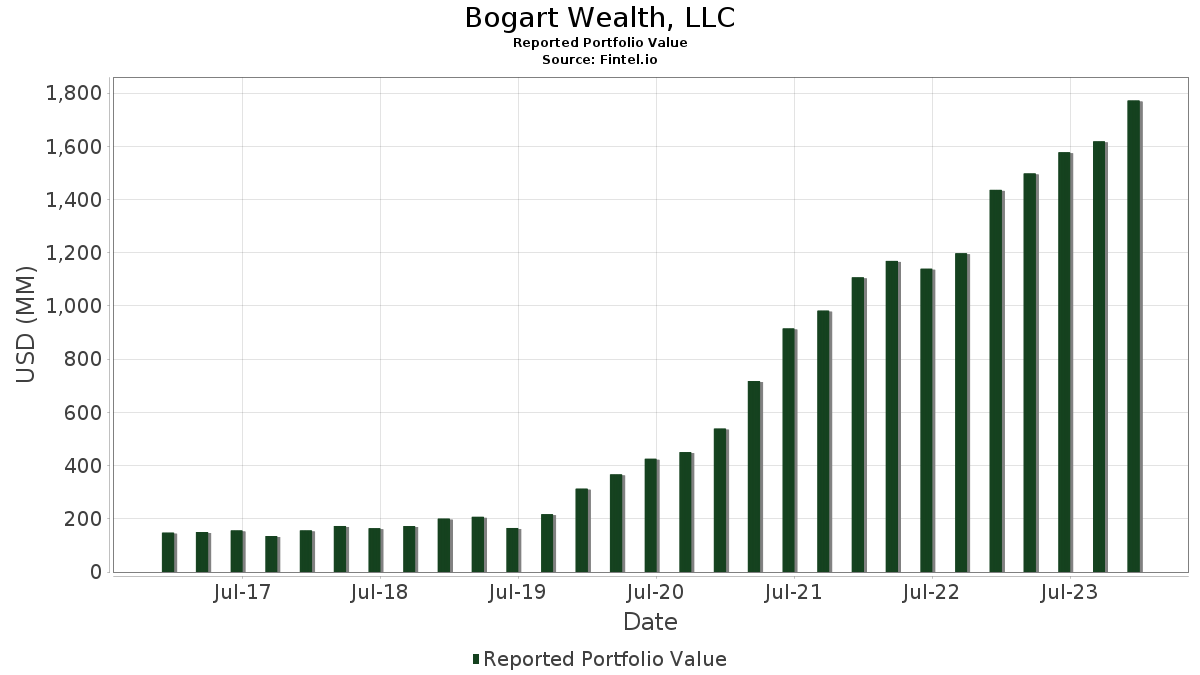

Bogart Wealth is an independent, fee-only wealth management firm. They provide advisory services to corporate executives, professionals, and families, guiding them on their paths to and through retirement. This Washington-based financial advisory firm is fielding up to 75 new leads a day, and boasts an organic growth rate of 39.7% (nearly 10 times the industry at large)!

Bogart Wealth's secret sauce was simple. It was content marketing through insightful blogs and clarifying webinars. It all began when James Bogart attracted clients with "informative chicken lunches", where he would hold a series of events tailored to customers' needs and concerns around retirement planning and financing. Over time, his efforts further spread into Zoom webinars, YouTube videos, and blogs that were "valuable, substantive, time-driven content". James Bogart's focus on publishing utility content was their main source of customer acquisition and helped to propel their growth massively over the years. As highlighted by the Founder, James Bogart himself, their success fundamentally comes down to "value creation and actionable utility", which helped open doors to other Fortune 500 companies and new international markets.

As Bogart Wealth experiences rapid expansion, with its staff more than doubling over the past two years in 2020, James Bogart also plans on maintaining their brand image of clarity and peace of mind; and what better way to demonstrate this, than through their content marketing efforts and aggressive and unique hiring standards. Bogart Wealth focused on desired mindsets and habits over educational qualification, and implemented an in-house career acceleration program, allowing their services and customer experience to align with their brand.

Their simple, yet effective implementation of clarifying and actionable educational events and unique talent acquisition schemes allows Bogart Wealth to be named the Top Investment Advisory Firm in Virginia, and 30th Nationally by Forbes!

Ritholtz Wealth Management

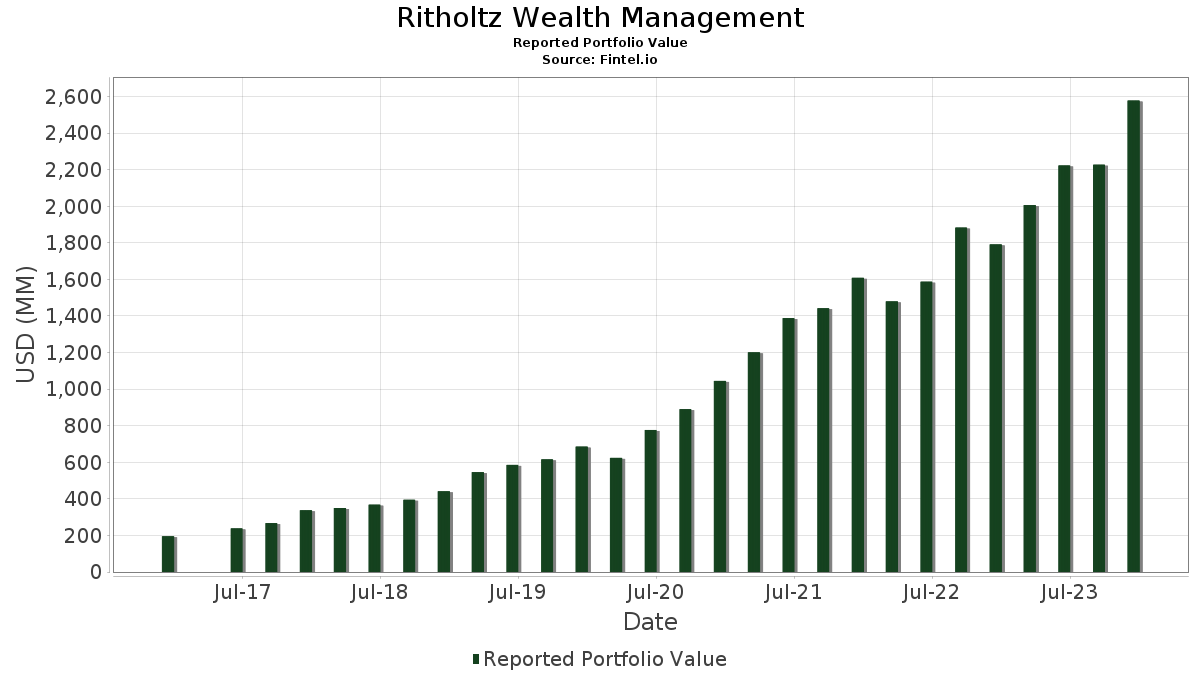

Ritholtz Wealth Management firm focuses on providing financial planning & asset management services, tax planning & preparation, insurance services, estate plan consulting, and corporate retirement plans in a more transparent and intuitive approach. This New York-based financial advisory firm has successfully cultivated a loyal and supportive customer base that helped them to manage more than $2.5 billion in assets as of 2022!

The brand image of transparency and reliability Ritholtz Wealth Management has built around its brand is the most prevalent force behind its continuously growing fan base of prospects and clients. Its fixation on "writing content that lets your firm talk directly with clients" is the heart behind the firm's brand identity and loyalty.

Ritholtz Wealth's growth strategy lies in getting people eager to consume and engage with their content through the founder and CEO's blog posts, podcasts, and other forms of media. As mentioned by Ritholtz Wealth Management CEO, Josh Brown, "Writing is an underrated marketing strategy". Their content marketing effort successfully targeted the optimal demographics and provided great utility and engagement with their audience; with Brown boasting 1.1 million Twitter followers, and the firm capturing over 50,000 followers across all social media platforms!

Josh Brown, and Ritholtz Wealth Founder, Barry Ritholtz's blog posts prove to be the most effective form of content marketing they have employed, even stressing about its significance during the InvestmentNews’ FinTech Virtual Summit. Their blogs typically cover key economic and financial trends, coupled with accurate coverage of their target consumers' concerns such as "How Much Is That $70,000 Truck Costing You?"; allowing the firm to promote transparency, and foster a deeper connection and understanding with its audience.

Gen Z Are Too Confusing for Boomers

— The Compound (@TheCompoundNews) January 31, 2024

🎙️@dhtoomey @Downtown

📽️https://t.co/Q5xUTMPAsG

🎧https://t.co/n8PdjGz7YS pic.twitter.com/VSDqDFvjPP

Moreover, Ritholtz Wealth also benefits from influencer marketing mainly through their podcast, "The Compound", where they discuss the latest insights in investing, economics, and finance. Through this podcast, they invite prominent influencers and experts in the space of finance such as Dan Toomey and Dan Ives, further promoting the firm's brand awareness and transparent culture, with the podcast garnering an impressive 138,000 subscribers on YouTube!

Therefore, Ritholtz Wealth's authentic communication of transparency and reliability through leveraging content marketing efforts, allowed Ritholtz Wealth to amass an enormous following, and experience exponential growth; with their AUM increasing more than 170% and doubling their client count within just three years!

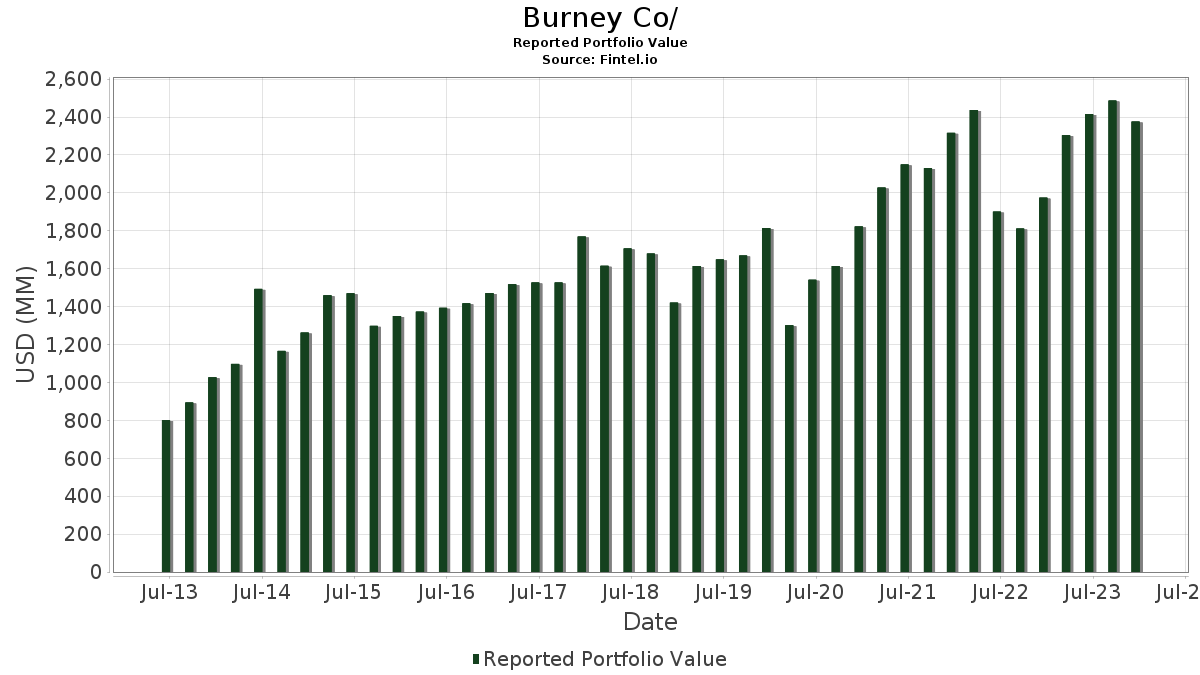

Burney Wealth Management

Burney Wealth Management is a renowned financial advisory firm that has been on a remarkable trajectory of growth; appearing in CNBC's Top 100 financial advisors in 2022, attaining a commendable 9th spot in the list. This Virginia-based advisory firm offers a concise service range consisting of financial planning, retirement planning, investment management, and tax planning and preparation.

But Burney Wealth's journey to success was not devoid of its challenges and complexities. The firm initially struggled to acquire clients through their traditional reliance on referrals, which were dwindling due to industry changes. Burney Wealth also lacked engaging marketing, website content, and optimal branding.

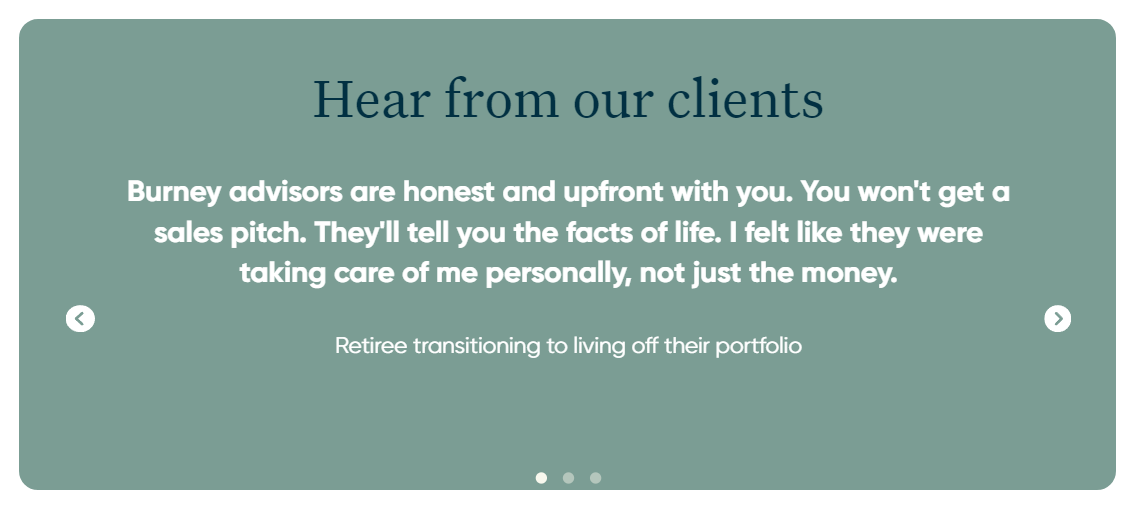

So, the advisory firm set out to bring about growth, starting with in-depth market research. The advisory firm interviewed clients to try and unravel their unique and ideal value proposition. After determining its ideal brand identity was the image of honesty, security, and care; they were later integrated into its content marketing strategies and employee branding efforts compellingly and cohesively.

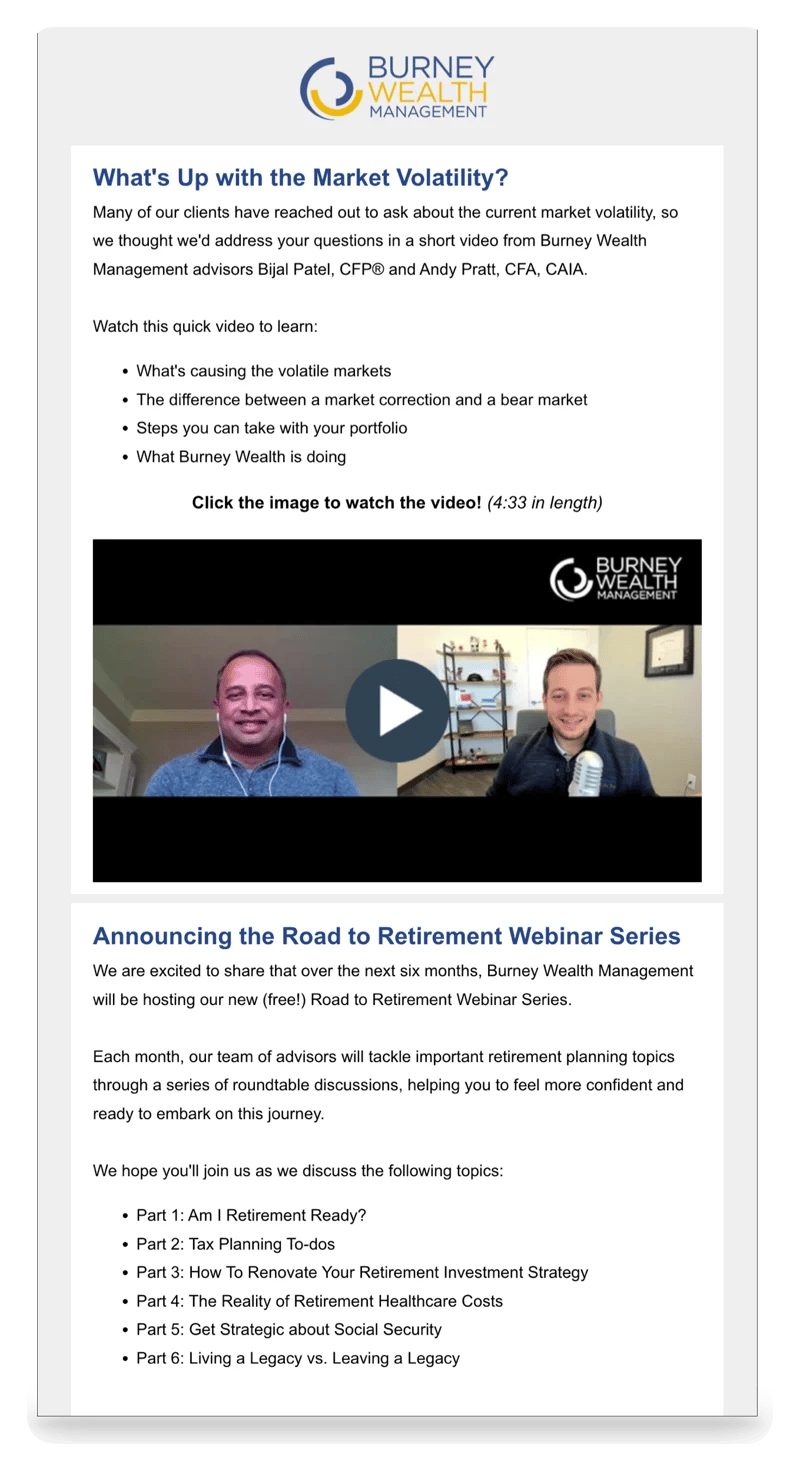

To convey their image of honesty, care, and security, Burney executed its content marketing through helpful blogs and webinars. The blogs are published with a jargon-free writing style and a sympathetic tone; usually sharing actionable tips, reminders, and guides. The free webinars further improve the user experience, as Burney Wealth follows a step-by-step content framework in their webinars, acting as a guiding force through clearing the individual's financial concerns. Overall the firm's use of blogs and webinars effectively communicates the honest and caring user experience its advisory services provide.

They also optimized their service process, placing the first meeting as a discovery meeting; where the advisors aim to build a deep relationship with the client, discussing aspects and lessons about life rather than the typical financial planning discussions. They also provide unique 1:1 personalized videos to clients and prospects, which helps foster a deeper connection with their advisor and sales team. These workflow optimizations further establish the brand image of care throughout the customer journey and experience.

Burney Wealth also introduced email marketing in their branding campaign, allowing them to stay top of mind, and engage with prospects and clients by sending them personalized 1:1 sales videos, blogs, and webinars. This helped prospects and clients further engage with the brand, with an outstanding 230% increase in monthly client webinar registrations!

Since their branding efforts, Burney Wealth Management experienced a 750% increase in contact conversions each quarter, as the firm effectively promoted their brand, and crafted a compelling brand image through coherent marketing strategies. This set the path for rapid growth and garnered increased customer loyalty toward the brand.

Indosuez Wealth Management

Formerly known as Credit Agricole Private Banking, is the 10th largest bank in the world according to The Banker 2022; a global player in wealth management. The organization's impressive growth and status are due to their ability to align their diverse subsidiaries worldwide into a cohesive cross-border platform for its clientele.

To execute a more streamlined and unified user experience, they employed a comprehensive approach by conducting thorough bottom-up research within the organization. This helped uncover the strengths and client trends the organization possessed, allowing them to craft a compelling new value proposition delivered through their brand identity of being 'Architects of Wealth'.

The main focus in communicating their brand is through meticulous narratives that resonate with the bank's core values and customer aspirations. This development process included the five-step brand promise methodology, ensuring the brand stories develop a precise connection between their customers' happiness and the bank's commitment to being architects of wealth. The narratives adopted a theme of 'Stories shape our lives', with elaborate and elegant visuals successfully engaging high net worth clients and developing a brand image of being meticulous and sophisticated with their financial management services; like architects.

Indosuez Wealth further emphasized their brand image, through their elegant-centered visual identity used across all their communication platforms; with its brand's color palette comprised of 'understated fawn and white with cerise highlights', and their typography consisting of Berthold Bodoni and Neue Helvetica text fonts.

Furthermore, Indosuez Wealth Management involved itself with strategic collaborations and partnerships with companies like Capgemini, which developed a seamless and unique banking platform. Exemplifying the bank's commitment to innovation and excellence further aligns their brand with the product, creating a more authentic user experience.

This successful launch of the organization's new brand campaign In 2016, it marked a turning point for them; experiencing significant expansions in key markets including Italy, Singapore, Hong Kong, Spain, and Monaco. Their enhanced market presence solidified their brand positioning and strengthened their connection with ultra-high-net-worth clients.

Salem Investment

This North Carolina-based financial advisory firm is a financial powerhouse, standing as a beacon of customer centricity and commitment. Salem Investments manages an impressive $1.7 billion in assets and is claimed to be the #1 financial advisory firm in the US for two consecutive years according to CNBC's Financial Advisory 100.

In the financial service space where fostering a sense of trust is paramount for success, Salem Investment was able to bring about impressive growth by strategically crafting a brand identity of integrity and commitment.

Leading the brand charge is David Rea, the president of Salem Investments. His immense passion and commitment to client-driven success permeates through their operation and has become the organization's core value. Salem Investment demonstrates this by pursuing individualized attention, tailored solutions, and building long-term relationships with clients. Therefore by aligning the organization's internal operations and employee approach with their core value, it effectively optimized Salem Investment's customer journey. This focus on customer-centircity and employee branding played a pivotal role in crafting the brand image of integrity and commitment among customers and further expanded through simple word-of-mouth.

The organization continues to act on their core values, boasting the fact that they are still a privately owned financial advisory firm, without affiliations that might compromise client interests—further cementing their brand image of integrity and commitment among the audience.

Hence, by simply staying true to the organization's core values and acting on them, Salem Investment was able to garner immense growth and word-of-mouth.

Ameriprise Financial Inc.

Ameriprise is a daughter company of American Express Company and is a leading financial planning firm in America, with the third highest Customer Trust Index score according to Forrester’s proprietary 2023 list. It has experienced astronomical growth over the years, with its elaborate branding and ad campaigns, allowing them to be an American Behemoth in the financial service industry, with $1.4 trillion worth of assets under management in 2023.

Taking up after their parent company, Ameriprise allocated a large chunk of resources to marketing and branding, spending $330 million on national ad campaigns, with $55 million of those on branding efforts alone. Breaking away from generic retirement marketing campaigns, Ameriprise has embarked on a transformative rebranding journey; shifting their commitment to align with their customer's sentiments and priorities.

Ameriprise committed their efforts to extensive market research to resonate with their target customers' emotions. Ameriprise realized that "big dreams" were going to be the center of their brand identity and purpose. Instead of selling to their target customers the generic notion of 'two people on the porch, looking at the sunset', they released ad campaigns around their new brand and made the Ameriprise Dream Book, which, according to their Chief Marketing Officer, Kim Sharan, "had the greatest response ever...the volume has been much larger than anticipated.".

With the use of Ameriprise's Dream Book not only being their lead generator but also guiding their financial advisors in service delivery, they excellently executed a compelling value proposition and customer experience that made big contributions to their growth and differentiation in the market, "We are all surprised at the incredible response rates. It’s exceeding all we’ve seen before.", says Brian Heath, President of US Advisor Group of Ameriprise.

Ameriprise also focused on strategic acquisitions. They acquired other asset management firms and brokerage firms which included Columnbia Treadneedle Investments, J. & W. Seligman & Co., and H&R Block Financial Advisory all near its rebranding efforts further to strengthen its position in the asset management industry and increase its presence in tax and financial advisory services. This allowed the company to stay authentic to their brand and effectively retain clients more efficiently post its marketing and branding efforts in the long run

Overall, Ameriprise's brilliant marketing and branding efforts, coupled with strategic acquisitions, allowed the company to exploit explosive growth opportunities, and over the years really compounded and cemented their presence in the financial service industry as one of America's most trusted financial advisory firms right now.

Conclusion

In conclusion, the success stories of these emerging financial advisory firms open up the need for a comprehensive growth strategy, particularly the ones that highlight the unique value and experience of your services to target customers. In a landscape saturated with quality financial services and established firms, conveying a unique value proposition and brand identity is necessary for differentiating from the market and achieving an impactful and sustained presence in the industry.

Each firm mentioned above employed strategic growth strategies to attain notable growth:

-

Bogart Wealth's focus on content marketing is a prime example of the effectiveness of producing worthwhile, time-driven content to draw in and keep customers. This includes instructive events, webinars, and blogs.

-

Ritholtz Wealth Management brand of transparency was communicated through influencer marketing, podcasts, and blogs. With the brand emphasizing the value of real communication, which cultivated a loyal and sizable clientele.

-

Burney Wealth Management commited to strategic rebranding by designing their user experience, sales approach and marketing initiatives to convey care and security to their clients; which they deeply valued. This alignment has led to notable growth, increased engagement, and strengthened brand engagement.

-

Indosuez Wealth Management demonstrated how a cohesive and aesthetically pleasing identity, and compelling narrative is crucial for building stronger relationships with high-net-worth customers and propelling worldwide expansion.

-

Salem Investment's dedication to client-driven success is evident in their brand identity of commitment and integrity; and by simply designing internal procedures and staff behavior, and acting according to fundamental values, the firm was able to unlock massive growth and word-of-mouth, building immense trust with their clientelle.

-

Ameriprise Financial Inc. showcased the benefit of connecting with customers on an emotional level, providing advisers with resources like the Ameriprise Dream Book, and growing their market presence efficiently through creative ads and strategic acquisitions that were in accordance to their brand identity.

Crafting a distinctive brand identity, communicating a compelling value proposition, and leveraging innovative marketing strategies are not just tools for visibility but potent drivers for securing a competitive edge in the dynamic and competitive financial advisory space. The focus on customer experience rather than simple product effectiveness and efficiency is gaining significant realization among major players in the space. Designing these optimal growth strategies for your business is pivotal in achieving relevancy and unlocking massive growth opportunities that still exist in the market.

But if you still seem underconfident and require more guidance tailored to your business's needs and circumstances, don't hesitate to click that "Book an Appointment" button. I and my team will be more than happy to conduct a free session to clear out doubts and strategize viable routes to take in your business's branding journey!